यदि अभी तक आपने अपने Pan Card (permanent account number) को Aadhaar Card से लिंक नही कराया है, तो इस पोस्ट में हम आपको पैन कार्ड को आधार से लिंक करने का तरीका (How to Link Pan Card to Aadhaar in Hindi) बताएंगे। लेकिन उससे पहले ये जानना जरूरी है कि Aadhaar Card को पैन से लिंक करना अनिवार्य (mandatory) क्यों है?

CBDT (Central Board of Direct Taxes) के अनुसार यदि आप अपने आधार नंबर को पैन नंबर से लिंक नही करते है, तो एक तय तिथि के बाद आपका Pan Card निष्क्रिय (inoperative) हो जाएगा। जिसके बाद आप इनकम टैक्स रिटर्न फाइल नही कर पाएंगे इसके अलावा आपको वित्तीय लेन-देन में कई दिक्कतों का सामना करना पड़ सकता है।

कुल मिलाकर आप परेशानी में पढ़ सकते है, इसलिये बिना समय गवाएं अपने Pan Card को Aadhaar Card से Link कर लीजिये। ये बहुत आसान प्रकिया है, जिसे आप अपने मोबाइल से भी कर सकते है। नीचे बताये स्टेप्स को फॉलो करके अभी पैन कार्ड को आधार से लिंक करे।

पैन कार्ड (Pan Card) को आधार (Aadhaar) से Link कैसे करे

स्टेप 1: अपने ब्राउज़र में इनकम टैक्स e-filling portal की वेबसाइट को ओपन कर ले – https://www.incometaxindiaefiling.gov.in/home

स्टेप 2: होम पेज पर आपको Quick Links वाले सेक्शन में “Link Aadhaar” का विकल्प दिखाई देगा उस पर क्लिक करे।

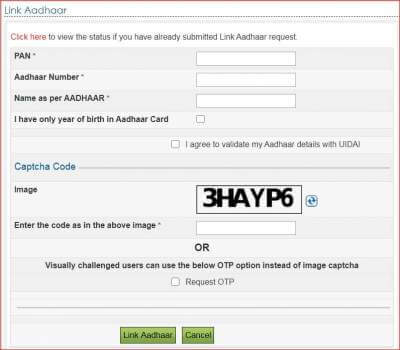

स्टेप 3: यहां अपना 1) पैन नंबर, 2) आधार नंबर, 3) आधार के अनुसार नाम डाले, 4) यदि आपके आधार कार्ड में सिर्फ जन्म वर्ष दिया गया है, तो वर्ग पर टिक करे, 5) UIDAI के साथ अपने आधार विवरण को मान्य करने के लिये में सहमत हूँ पर टिक करे, 6) अंत मे Captcha Code डाले और Link Aadhaar पर क्लिक कर दे।

आधार के सत्यापन के लिये आपका अनुरोध UIDAI को भेज दिया गया है। अब आप होम पेज पर Link Aadhaar पर क्लिक करके इसकी स्टेटस चेक कर सकते है।

पैन कार्ड आधार से लिंक है या नही कैसे पता करें?

स्टेप 1: इस लिंक को कॉपी करके ब्राउज़र में ओपन करे- https://www1.incometaxindiaefiling.gov.in/e-FilingGS/Services/AadhaarPreloginStatus.html

स्टेप 2: अपना Pan और Aadhaar Number टाइप करें फिर ‘View Link Aadhaar Status’ पर क्लिक कर दे।

यदि आपका पैन आधार नम्बर से जुड़ा होगा तो आपको इस तरह का मैसेज दिखाई देगा ‘Your Pan is Linked to Aadhaar Number’ तो इस आसान तरीके से सिर्फ 5 मिनट में आप Pan Card को Aadhaar से Link कर सकते है। तो उम्मीद इस लेख को पढ़कर आप कुछ सीख पाए होंगे। पोस्ट से सम्बंधित अपनी राय व सुझाव को नीचे कमेंट में बताये। आप चाहे तो इसे दूसरे लोगों तक शेयर करके उनकी मदद कर सकते है।

सम्बंधित लेख – आधार कार्ड अपडेट कैसे करते है

Hi

Nice information.

sir, I am a big fan of you, I see your post daily and get very good information.it, please approved it

(link deleted by admin)